CRD Association provides various services related to credit risk measurement for CRD members.

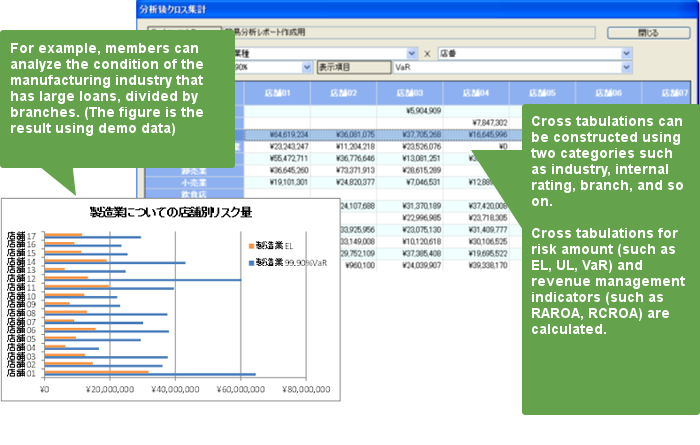

Risk is divided by industry, branch, and other classifications. Furthermore, by using this system, it is easy to compare risk over time and across any group.

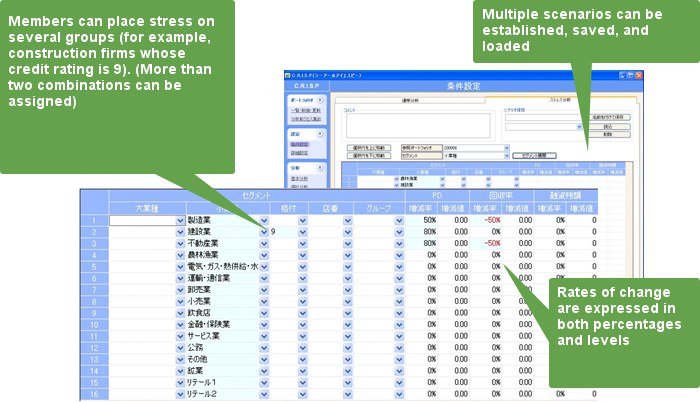

This system predicts the change of risk in the case of the stress caused by a change in the business cycle, market environment, and/or management policies.

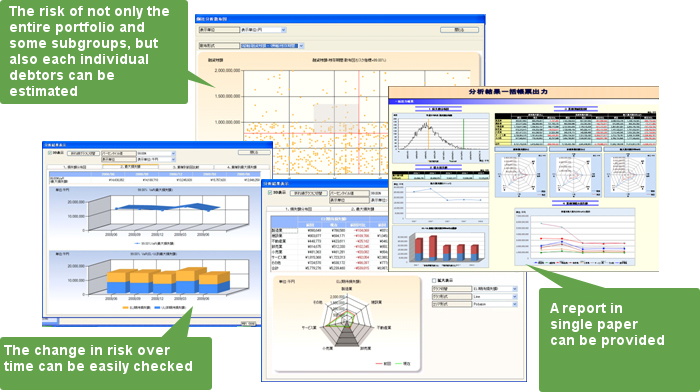

This system regularly measures credit risk. If risk in the current period changes compared with the previous period, the system analyzes the cause and impact of the change in risk.

Furthermore, by identifying the cause of the change in risk, the system indicates the target of risk management (for example, probability of default or protection of debt) and the effectiveness of risk management to the change in risk. If the cause is correlation of default, the effectiveness is low.

Correlations of default caused by customer relationships and capital ties are important for estimating credit risk. If the correlation is ignored, credit risk would be underestimated. This service provides correlation of default using client data of each CRD member and/or CRD. This service provides estimates on the "correlation of default in each industry" and the "contribution of macro factors to default."

CRD members can choose one of the following systems.

CRD members provide client data for credit risk measurement and then CRD Association provides reports including the estimated risk from C.R.I.S.P and portfolio analysis using the estimated risk.

CRD Association calculates the following risks:

In addition to the credit risk measurement of entire portfolios, the risk of subgroups divided by credit rating, branch, and other categories can be calculated. By measuring the credit risk of a particular subgroup, members can check biases in credit risk and the effects of large borrowers.