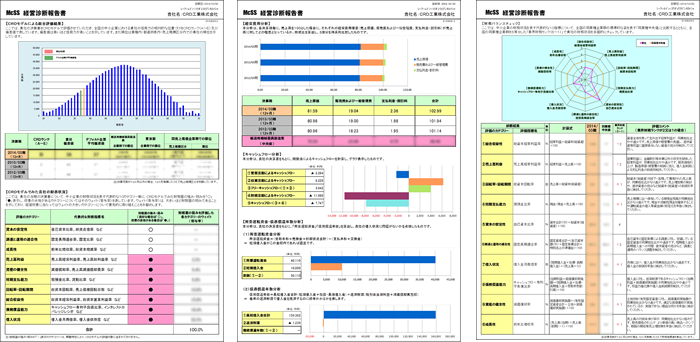

The Management consulting Support System (McSS) is a tool for the diagnosis of the financial conditions of clients' SMEs. The concept of the McSS is "easy understanding and manipulation", which improves communication with client SMEs.

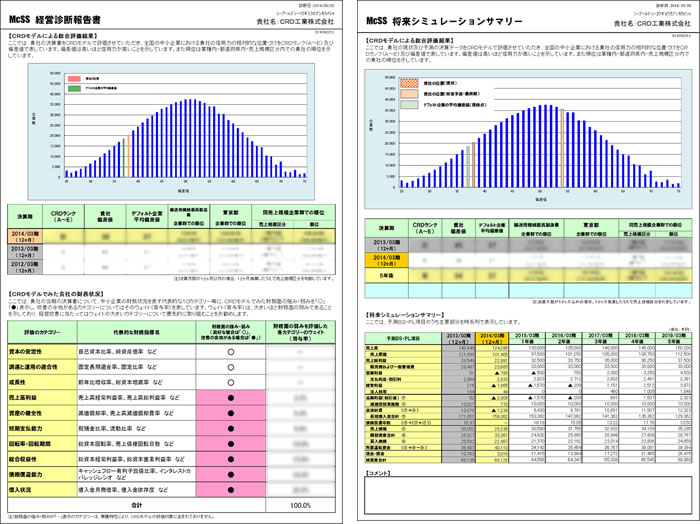

The McSS evaluates the financial statements of client SMEs using CRD Model(for corporations), which is the scoring model used by the public guarantee corporations to determine guarantee rates. Moreover, the McSS evaluates the current conditions of SME clients by comparing them with average firms in the CRD, which contains data of more than 1 million SMEs.

In addition, if the expected main cash flow items (for example, expected sales and cost of goods) are included in the McSS, predicted financial statements up to 10 years in the future can be estimated. Simulations that compare current and predicted financial conditions can be run.

There are two versions of the McSS: McSS_Simple and McSS_Simulation. McSS_Simple is designed to diagnose the current financial conditions of SMEs. McSS_Simulation is designed to both diagnose and forecast the financial conditions of SMEs.