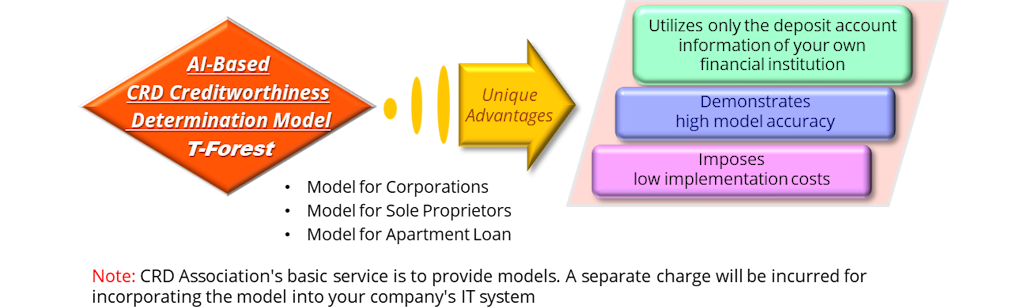

T-Forest is an innovative credit risk assessment model that utilizes solely deposit account information, offering a critical tool for efficient credit management. Compared to financial statements, deposit account data is considered more reliable as it is readily accessible and free of any window dressing issues. Introducing T-Forest as a supplement to financial statements will significantly enhance a bank’s credit management practices.

Beyond its role as a short-term screening model, it facilitates the early identification of abrupt bankruptcies stemming from cash flow insolvency. This capability is anticipated to result in enhanced assessment of creditworthiness, reduced lending-related costs, and improved operational efficiency.

T-Forest is designed to enhance operational efficiency, mitigate costs, and bolster profitability.

No external data from other institutions or financial entities is necessary; information on deposit accounts of customers engaged in transactions within the bank is sufficient for the evaluation.

Conduct precise monthly assessments of the creditworthiness of all customers engaged in deposit transactions.

Easy start by installing the Excel tool on your computer and initiating its use.

Support busy bankers to monitor their clients.

Mitigate the risk of sudden bankruptcies through early detection and prompt action, leading to a reduction in credit costs.

Utilize it as an effective screening model for expanding loans to new clients, thereby augmenting revenues.

Promoting the use of deposit account information held by financial institutions as a cornerstone for DX strategies.

In the times of high uncertainty, "T-Forest" adeptly supports the efficient monitoring of business partners.

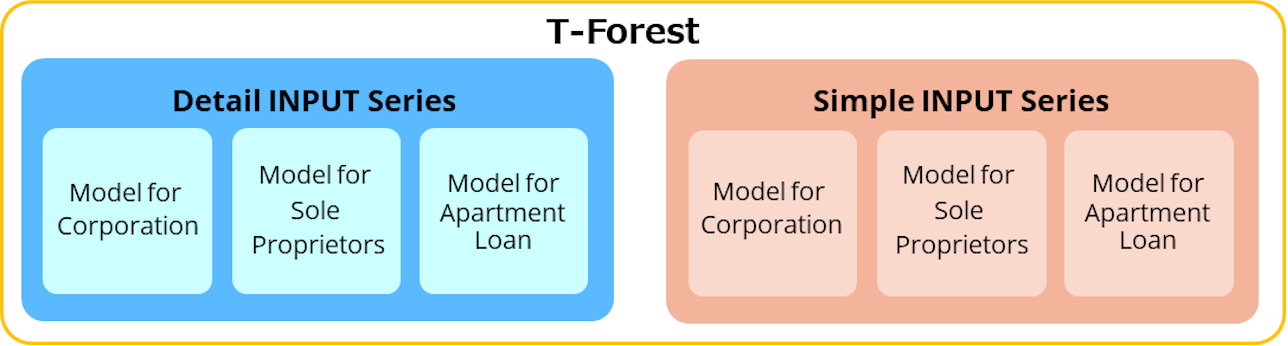

The Detail INPUT Series comprises a set of models designed for inputting and scoring transaction data categorized into ten distinct types of items. Leveraging this detailed information, the evaluation results are expected to attain higher accuracy.

A group of models that input and score data in which transaction histories are aggregated into two types: deposits and withdrawals. The burden of data preparation is reduced, and the level of difficulty of implementation is low.

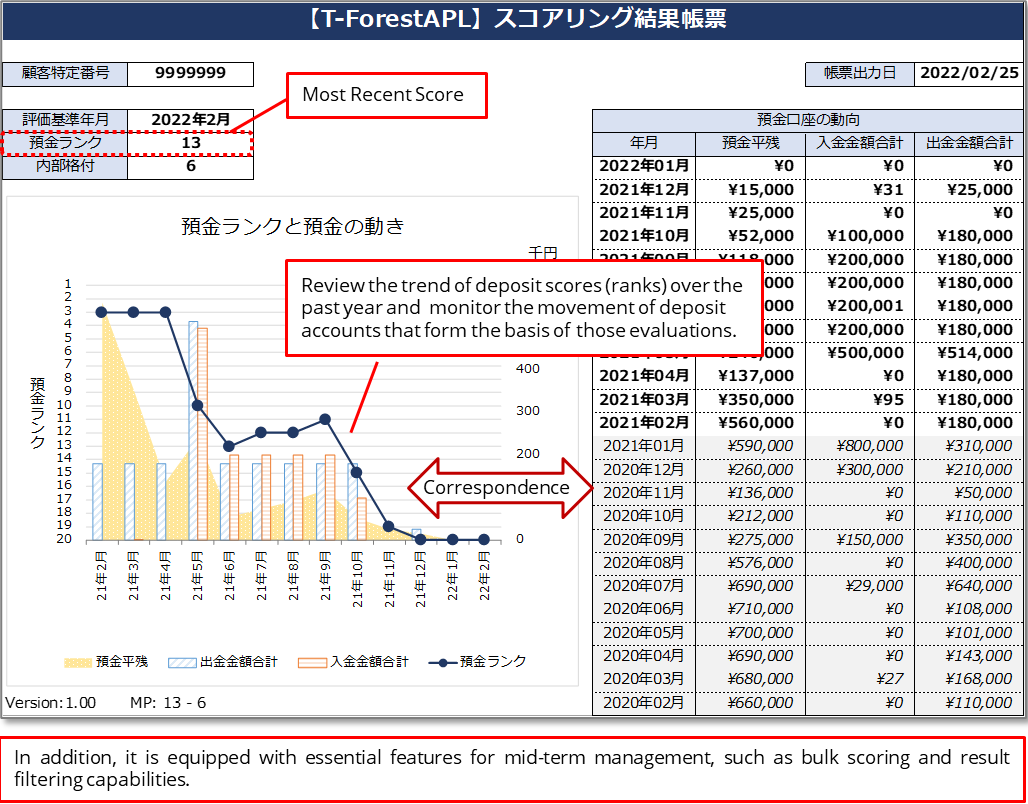

An option to use the Excel tool for mid-term management is also available, with the image above showcasing a segment of the tool report.

For further inquiries or assistance, please do not hesitate to reach out to us.

Click here to download the brochure.

* Only the Japanese version is available.

Click here to contact us.